March 23, 2023

Dear customer

Please find below the summary of this newsletter

- Has overcapacity returned to shipping?

In an interview with the Freight Buyers Club, former chairman of Evergreen and Yang Ming, Bronson Hsieh, states that “a container ship orderbook totaling over 7 million TEUs alongside a declining global market threatens overcapacity”. A surplus in equipment, sufficient trucking availability and increasing vessel capacity are dictating freight tariffs in the first half of 2023.

- Schedule reliability

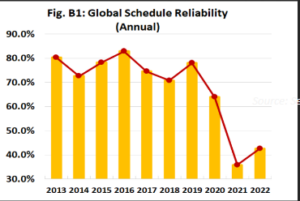

Global schedule reliability improved from 30,4% in January to 56,6% in December 2022. Schedule reliability dropped from 78% in 2019 to 35.8% in 2021, the lowest recorded to date. Despite a marginal improvement of 0,01% in December ’22 compared to November, data is indicating continued improvements in the reliability of the supply chains.

- Break-up of the 2M alliance

MSC and Maersk, the two largest ocean carriers, have announced a breakup of their vessel sharing alliance which they have participated in together since 2015. Although the alliance does not expire until 2025, increased competitive pressure between the carriers could lead to lower rates in the short term, according to Lars Jensen, CEO of Vespucci Maritime. These lower rates, however, could come at the expense of more volatile service and a higher number of blank sailings.

- Trucking availability

Due to record high fuel prices and a worsening driver shortage, road freight transport costs rose by 13% across Europe in 2022. In 2023, all-round demand and trucking availability have regained their balance. However, factors as increased labor costs, the backlog in newbuild vehicles and the mobility package are pressurizing trucking companies’ margins.

Has overcapacity returned to shipping?

UK consultants Drewry have estimated that liner shipping made record combined operations profits of $290bn last year, investing a good chunk in their future container shipping fleet.

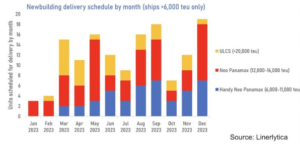

The orderbook as a percentage of the current fleet stands at 29,5% according to Alphaliner, with majority of the capacity being delivered over the next two years.

2,3M TEU of container vessel capacity has an expected delivery in 2023.

Therefore, the short answer to abovementioned is YES, but there are several countermeasures available to the carriers. The six-month demand collapse in 2020 due to Covid-19 has shown that carriers are well equipped to reduce their capacity. The question is: will these measures be re-applied?

- Slow steaming, deliberately reducing the speed of cargo ships to cut down fuel consumption and carbon emissions. By doing so, carriers can introduce extra vessels in their rotations without increasing capacity.

- Vessel lay-up, temporarily removing a ship from commercial service

- Blank sailings, carrier’s decision to not call specific ports in order to optimize operations and thus reduce capacity

- Vessel scrapping, retiring older vessels and sell them to a scrapyard

- Postponing and cancelling the container orderbook

Sea-intelligence’s latest report shows indeed liner operators cut capacity by 18% in the lead-up to the Chinese New Year holiday, primarily focusing on blank sailings.

Furthermore, Xeneta expects that 25% of the scheduled orderbook will be postponed, while no more than 10% is expected to be cancelled.

Drewry states that as much as 600.000 TEU could be scrapped and recycled this year, adding: “However, despite this being close to record levels, because orderbook delivers are so heavy this year and demand is stalling, we don’t think the market will be able to avoid overcapacity.”

Schedule reliability

Ever since the second half of 2020, schedule reliability has been very poor. While schedule reliability did not deteriorate in the first few months of 2022, it did not improve either. This all changed in the second half of the year, as there were significant improvements, across all metrics of schedule reliability, be it on a global level, across the major carriers and alliances, or even for the major East/West trade lanes. Yet, there is still a long way to go before we reach the pre-pandemic levels.

For December ’22 there was only a 0,01% increase in reliability, however historically the transition implies a 3,1% reduction in reliability – resulting in a net increase of 3,11%. For shippers across the globe these statistics result in a more stable planning regarding production as well as stuffing of containers. Delays in transshipment ports and all-around vessel delays due to port congestion will be less common, thus securing a more steady flow of on the import side. Terminal operations on both land and waterside will also benefit of the increased schedule reliability, reducing the occupancy rate which on its turn has a positive impact on the container terminal’s efficiency.

Source: Sea-Intelligence, 2023

Break-up of the 2M alliance

Vincent Clerc and Soren Toft, CEO’s of respectively Maersk and MSC, recognize that much has changed since the two companies signed the 10-year vessel sharing agreement in 2015. Discontinuing the 2M alliance paves the way for both companies to pursue their individual strategies. In broad terms, we will see a market change from 3 major operators (2M, Ocean Alliance, THE Alliance) to a market of 5 operators, in which Maersk will be the smallest player.

Subsequently, Drewry does not expect Maersk to see membership of an existing alliance, or trying to form a new one. Maersk believes that its integrator model will be more attractive to customers and deliver higher returns for shareholders. If Maersk is right – that being an integrator within an alliance is unworkable – then companies with similar aspirations such as CMA CGM in the Ocean Alliance, will have to consider a breakup of their own. Further pressurizing ocean freight prices at the cost of sailing frequency and port coverage.

Meanwhile MSC has doubled down on ocean shipping. The company upped its capacity through new vessel orders and by “aggressively raiding the second-hand and charter market’s,” according to a Drewry report. By doing so, MSC could possibly return to its old business model of a high volume at a low cost.

Trucking availability

Despite low demand and thus increased trucking availability – a reduction in spot prices is limited since carriers operate on very slim margins. Assuming Europe starts to recover in the second half of ‘23, Thomas Christenson, COO of Sennder expects large rate increases as structural weaknesses such as the driver shortage kicks back in and oil prices return to historic trajectories.

The International Road Union (IRU) continues to draw attention to the acute driver shortage. The decline in driver shortage is only temporary and the medium-term outlook is grim, as in 2026 a third of Europe’s truck drivers will have reached the retirement age. Without urgent regulation, for example the EU’s current revision of driving license rules, freight rates will rise again in the coming quarters to potentially unsustainable levels, which in turn will fuel inflation.

The Shipex team