Shipex Market Update July 2023

Dear customer

Please find below the summary of this newsletter

Have rates hit their bottom?

In the long term, prices stagnate once supply and demand are in equilibrium. On the demand side, FourKites analysis predicts that volumes will pick up in Q3 and Q4, but at a slower pace than in 2022, which should mean an easing of delays and available capacity heading into peak trading seasons. The difficulty lies in predicting supply - when, where and at what pace carriers will bring their newborn capacity to market.

Vessel sharing alliance agreements falling to a three year low

According to a survey by Alphaliner, only 38.9% of the world's containership capacity was operated in conjunction with alliance partners as of 1 January, well below their combined capacity of 83%. The independent charge is being led by MSC with its aggressive market share growth strategy and the launch of a number of new services. As carriers increase the amount of capacity operated outside their alliance, competition is likely to intensify at both operational and procurement levels. Drewry notes that port and terminal executives are bracing for an aggressive approach from carriers in their annual contract negotiations.

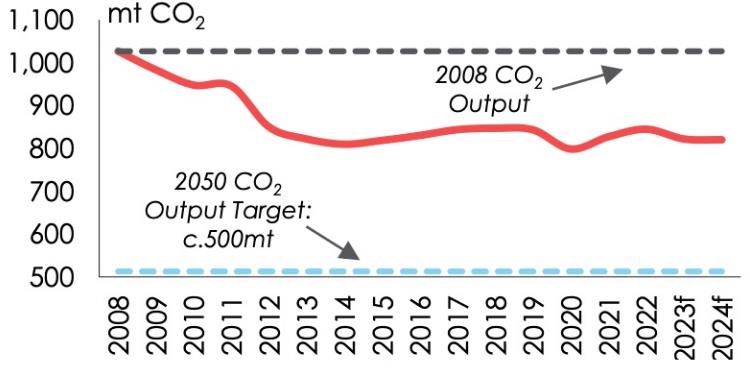

Containerships moving at all-time low speeds

During the COVID pandemic, strong demand and widespread port congestion led liner operators to increase average sailing speeds by up to 4.5%. Today, the situation is very different and in the second quarter of 2023, the average sailing speed has slowed down to 13.8 knots, a decrease of 6% compared to the previous year, with BIMCO suggesting that this speed could decrease with 10% by 2025. Slow steaming is the top trick in the container shipping playbook, as it partially offsets capacity of the newbuilding wave, saves on fuel costs and helps to comply with IMO regulations.

Advisory

With the shipping market almost back to 2019 pre-corona tariffs, it may be opportune for shippers to discuss a long-term contract for their key trade lanes. Shipex will be happy to advise you on this matter.

Shipping lines will make every effort to increase freight rates in the coming months. Market forecasts from Drewry and Xeneta point to the possibility of so-called GRIs (general rate increases) after the summer. The success of such initiatives will depend on the economic situation this autumn, based on export volumes versus market capacity – per trade.

Have rates hit their bottom?

In a 10-year rate analysis, Shipex can indicate the following

- Far East, rates are at their all-time low

- Middle East, rates are approaching their all-time low

- US West Coast, rates are at their all-time low

- US East Coast, rates are at their all-time low

- Central America, rates are approaching their all-time low

- South America, rates are approaching their all-time low

- Africa, rates are approaching their all-time low

- Oceania, rates are at their all-time low

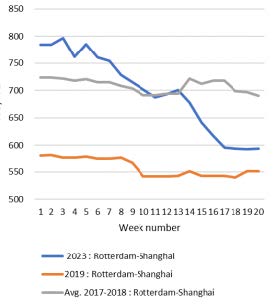

Figure: N. Eur-Asia 2023 vs. pre-pandemic

"The impact of this on the industry as a whole is there for all to see."First-quarter casualties include Zim, back in the red this month with a $58m loss, while CMA CGM, which last week revealed a 64% fall in pre-tax profits, issued an ominous warning that the first quarter could be its best as industry earnings "continue to normalise".

Hapag Lloyd reveals that its transport costs rose by $43 per TEU in Q1 compared to Q1 22', driven by a 5.4% increase in vessel costs, a 7.5% rise in bunker costs and a huge 14.8% jump inequipment and repositioning costs, attributed to inflation and an overhang of empty equipment.

Source: Sea-Intelligence, 2023

Vessel sharing alliance agreements (VSAs) falling to a three year low

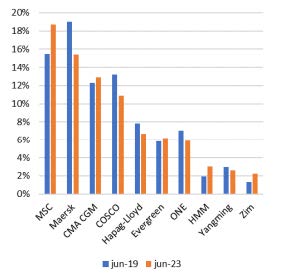

The termination of the 2M alliance - officially at the end of 2024 - will significantly reduce the percentage of capacity tied in VSAs, as MSC and Maersk operate largely outside vessel pooling arrangements. MSC is already the carrier with the lowest tonnage tied in VSAs. According to Alphaliner data, the number one has only 25% of its 4.9 million TEU capacity tied up in VSAs, compared with 39% for Maersk and 47% for CMA CGM. At the other end of the scale, Taiwanese carrier Yang Ming allocates 80% of its 705,000 TEU fleet capacity to alliance services.

Figure: Market share based on capacity

Source: Sea-Intelligence, June 2023

However, MSC has no plans to go it alone, as CEO Soren Toft told CNBC: "On some routes we may decide to go it alone and on others we may still have certain alliance-type structures." For example, 94% of capacity on the Far East - Europe (Northern Europe and Mediterranean) trade is currently operated under alliance services. This is the longest of the major east-west routes and presents the highest barrier to entry for new carriers, with services requiring a minimum of 10 vessels of at least 13,000 TEU to remain competitive. It remains to be seen whether the decline in vessel sharing will lead to improved operational efficiency and a downward pressure on freight rates.

Containerships moving at all-time low speeds

The average speed of the global box fleet dropped about a knot in the last two years. That may not sound like much, but from a global average of 14.6 knots, it is about 7% slower - which means you need X% more tonnage to move the same volume of cargo. “Slowing down is a well-used tool in the carriers' toolbox. Over the past couple of decades we have seen it used whenever there is either structural overcapacity or high fuel prices - or both. Now the industry is facing both," says Lars Jensen, Vespucci Maritime.

The record avalanche of newbuilds coming out of Asian shipyards is being injected into services that are moving slower and slower. Maersk and MSC, for example, announced beginning of June that they would add nine vessels to the Asia-Europe trade, while mentioning that these services would run up to three days slower than before, absorbing all the new capacity. With lines expecting difficult conditions to persist for some time due to sluggish demand and an extraordinary order book to deliver, carriers have been adjusting their fleets to sail slower. South Korea's HMM, for example, announced last month that it would replace the propellers on six containerships with more efficient ones specially designed for slow steaming.

From a shippers’ perspective, the further application of slow steaming could offer extra flexibility by carriers regarding the decrease in freight rates. From an operational point of view, additional vessels in rotation will result in more available days for container stuffing due to more frequent port calls. However, as mentioned above, there will be longer transit and therefore lead times.

Figure: International shipping CO² emissions

Source: Clarksons Research, IEA

The Shipex team